Difference between revisions of "Documentation/How Tos/Calc: XIRR function"

From Apache OpenOffice Wiki

< Documentation | How Tos

OOoWikiBot (Talk | contribs) m (Robot: Automated text replacement %s) |

OOoWikiBot (Talk | contribs) m (Robot: Automated text replacement %s) |

||

| Line 21: | Line 21: | ||

{{Documentation/SeeAlso| | {{Documentation/SeeAlso| | ||

| − | * [[Documentation/How_Tos/Calc: IRR function|IRR]] | + | * [[Documentation/How_Tos/Calc: IRR function|IRR]] |

* [[Documentation/How_Tos/Calc: MIRR function|MIRR]] | * [[Documentation/How_Tos/Calc: MIRR function|MIRR]] | ||

Revision as of 14:47, 26 February 2009

XIRR

Calculates the internal rate of return of a series of irregular cash flows.

Syntax:

XIRR(payments; dates; guess)

- payments is a range containing the payments made or received, at irregular intervals.

- dates is a range containing dates on which the payments were made or received.

- guess (optional, defaults to 10%) is a first guess at the rate.

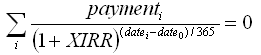

- XIRR iterates to find the rate of return which gives a zero net present value for the cash flows. At least one of the cash flows must be negative and at least one positive - to allow the net present value to be zero. The rate of return is per annum, and interest is assumed compounded annually, with a year assumed to be 365 days long. Specifically, the equation solved is:

- The order in which the payments/dates are stated is not important, except that the first payment given must have the earliest date.

Example:

XIRR(A1:A4; B1:B4)

- where A1:A4 contain -2750, 1000, 2000, and B1:B4 contain dates "2008-02-05", "2008-07-05", "2009-01-05" returns approximately 0.124, or 12.4%. The dates once entered into B1:B4 will display as set in the current locale.

Template:Documentation/SeeAlso

Issues:

- This function does not currently accept arrays.